Introduction

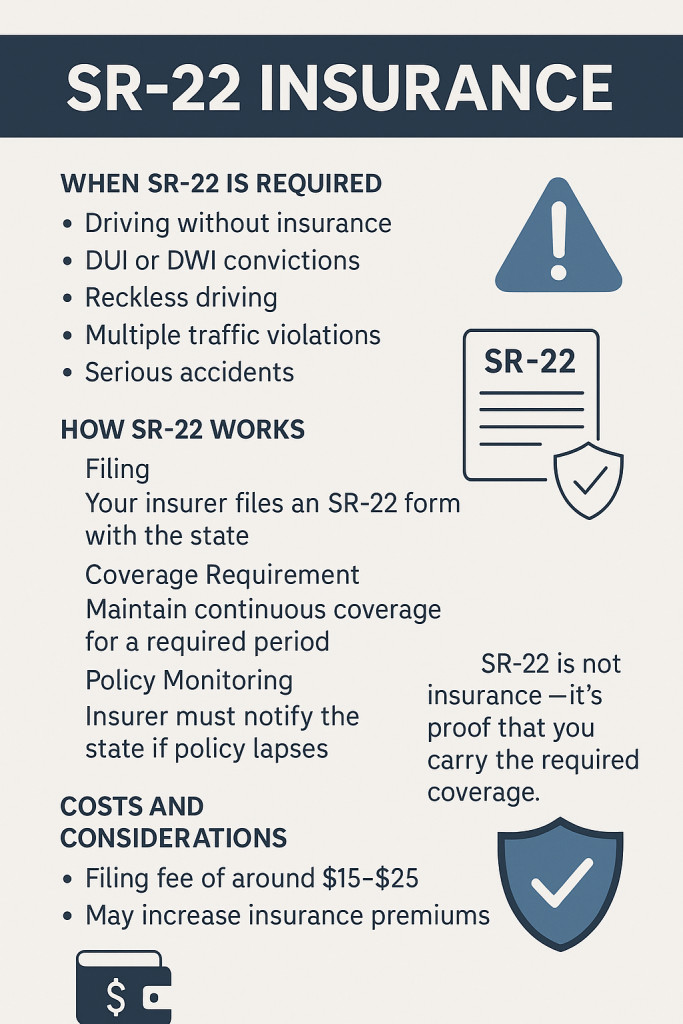

In Utah, some drivers are required to file an SR-22 as proof of financial responsibility. It is not an insurance policy itself, but rather a certificate filed by your insurance company with the Utah Driver License Division (DLD) to verify that you have the required auto insurance coverage.

When SR-22 Is Required

You may need an SR-22 if your license has been suspended or revoked due to:

-

Driving without insurance.

-

DUI or DWI convictions.

-

Reckless or negligent driving.

-

Multiple traffic violations within a short time.

-

Serious accidents caused while uninsured.

How SR-22 Works

-

Filing – Your insurance provider files the SR-22 form with the state on your behalf.

-

Coverage Requirement – You must maintain continuous insurance coverage for the required period (usually 3 years in Utah).

-

Policy Monitoring – If your policy lapses, your insurance company must notify the state, and your license may be suspended again.

Costs and Considerations

-

Filing an SR-22 typically costs around $15–$25, but your overall insurance premium may increase due to the violation.

-

Not all insurers provide SR-22 filings; you may need a specialized provider.

-

Once you’ve met the requirement period without lapses, the SR-22 can be removed.

Why It Matters

The SR-22 requirement ensures that high-risk drivers maintain continuous coverage. Failing to comply may result in extended license suspensions, fines, or further legal consequences.

Takeaway: SR-22 is not insurance—it’s proof that you carry Utah’s required liability coverage. It is usually required for high-risk drivers and must be kept active for the full state-mandated period.